The stock market: Why should teens start investing now?

January 23, 2021

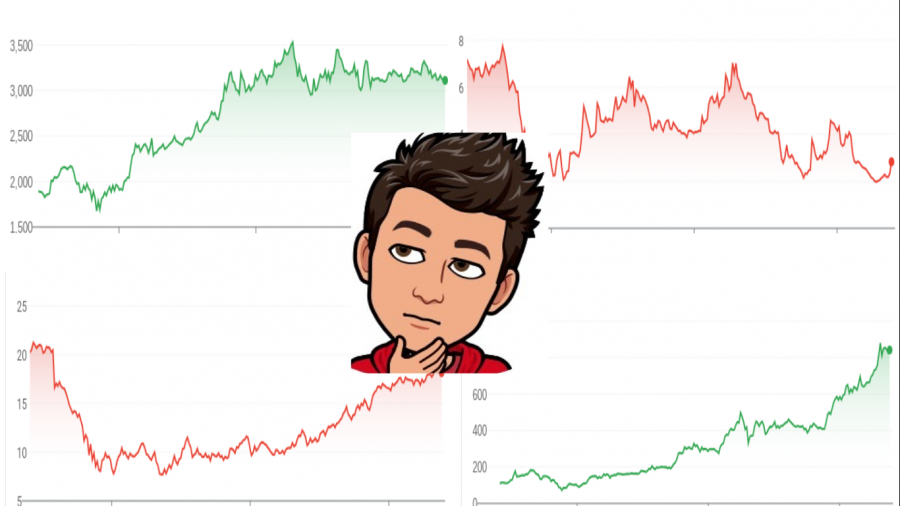

Investing in the stock market is something most students only hear mentioned in Financial Literacy class, even though it is one of the most opportunistic parts of the economy. Recently, after hearing news about the skyrocketing Tesla stock, I developed an interest in investing. It uncovered a whole new world of money-making opportunities, and I believe that every person should know about this before they graduate high school.

If teens start investing at a young age, they have quite a high chance of making a large profit in their future, especially for their retirement, a time that most young people can’t even imagine. Investing takes patience. If people go into investing with the mindset that they’ll become rich overnight, they’re going to watch their money drain from their pockets. Smart long-term investments will help people later on in life, and, if they’re lucky, they could amass quite a sum of money.

Exploring the stock market and investing early on could lead to discoveries of new and promising companies. If someone had invested just $140 in Apple when they hit the markets in 1980, that same 140 would be worth $2.8 million now. In June of 2017, Brandon Smith invested $10,000 in Tesla. He kept progressively putting money into Tesla stock, and by the time he stopped investing, he had put $90,000 into Tesla stock. Fast forward 4 years into 2021, and Smith is now a millionaire.

“I’ve taught money finance and economics and we do a stock market activity where it shows how much money you could’ve made if you had invested X amount of years ago. We use companies like Google, Apple, and Amazon to show the gains you could’ve made,” said Economics teacher Jeb Beaver.

Most professional investors advise to purchase and hold stock, not “play the market,” which comes with considerable risk.

Investing can go from being a fun learning activity in school to being a great shared interest with a parent. My dad and I work together to make the best decisions with our money. So far, we’ve only made a little bit of money, but I know that if we are patient, we can build a profit that could be applied to college savings or a major purchase.

About half of American households are indirectly affected by the stock market investing because they have 401(k)’s or other retirement accounts invested in the market on their behalf.

“I’m personally invested with stocks through my retirement accounts. This past spring, I definitely lost money, like everyone else, due to Covid, but it’s bounced back nicely, which is a positive, but seeing how much money was lost in the spring definitely makes you question putting a lot of money in the stock market,” said Beaver.

While I might have made investing seem like a magical, lucrative opportunity, be aware that many investors lose money. Everyone does or will at some point. Who could have predicted a pandemic and prepared for its effect on the market?

However, If an investor researches the company and learns how to read the stock information, then yes, there is a much better chance of predicting a gain or loss. Investing in the stock market is sort of like gambling– It’s betting that a company will do well, but anything can happen.

Instead of investing real money, many companies offer simulations with fake money, but with real-time stocks. These simulations can help students learn the process without risk.

“We use a stock market website/game in various classes that can show if you can handle the stock market using fake money. It’s a really good tool to start out with, and I do believe that high schoolers should practice with the stock market. I know the students that I’ve had in the past have really enjoyed playing the game,” said Beaver.

There are several games/resources that can be found by simply typing “Stock market games” into Google (Some of them cost money to play). Here’s a couple free-to-use ones: